For details on cashier's checks that have been lost, stolen, or destroyed (stop payment), click here. For money order stop payment, click here for additional details.

Capital City Bank issues official checks drawn on the following accounts:

- Interest/Club Check - 100008211

- Expense Checks - 100007411

- Mortgage Servicing - 7375296601

- Residential Lending - 7370944601

- Loan Servicing Escrow - 7388541001

If an official check drawn on one of these accounts is lost, stolen, or destroyed, clients can request a replacement item.

To replace a CCB-issued official check, do the following:

- Determine the identity of the client in person.

- E-mail _ESRecon Group to determine if the official check has not been paid.

- Do not continue until you receive confirmation that the check has not paid from the ESRecon Group.

- If it has already been paid, stop. You cannot continue.

- Once you have confirmed the check has not paid, in Xperience > SilverLake > Streamline Platform Menu > Recall existing accounts from core.

- On the Inquiry/Website Selection screen click OK. The StreamLine Account Recall Selection screen displays.

- From the Application drop-down menu, choose the application type.

- In the Account Number field, enter the account number from which the original lost, stolen, or destroyed check was issued.

- 100008211 - Interest/Club Check

- 7375296601 - Mortgage Servicing

- 7370944601 - Residential Lending

- 7388541001 - Loan Servicing Escrow

- In the Platform Type field, select the platform type.

- Select MO.

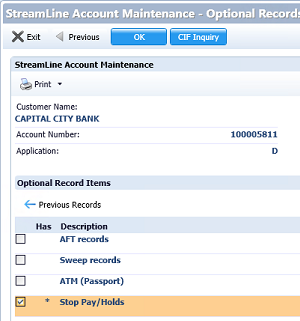

- Click OK until the Optional Record Items pane appears.

- Select Stop Pay/Holds.

- Click OK. The Stop Pay/Holds field must reflect No records available.

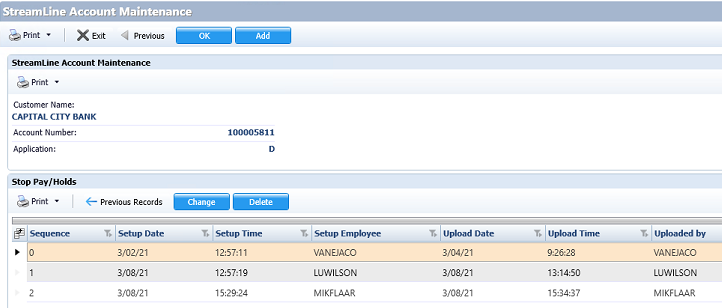

- If any records display in the Stop Pay/Holds field, delete each uploaded item.

- If any records display in the Stop Pay/Holds field, delete each uploaded item.

- Click Add.

- Click OK.

- Complete the following fields:

Line 5 - Verify Check Has Not Been Paid

Click the ellipsis to choose Y.

to choose Y.Line 20 - Date Placed

Enter today's date.

Line 30 - Request Received

Click the ellipsis to choose B - By phone, I - In-Person, or O - Other.

to choose B - By phone, I - In-Person, or O - Other.

Line 60 - Time Accepted

Enter the time.

Line 70 AM or PM

Enter AM or PM accordingly.

Line 80 - Remarks (Reason)

Enter one of the following:- Lost check

- Stolen check

- Destroyed check

Line 85 - Payee or ACH Originator

Enter the client's (purchaser's) name.

Line 95 - Stop Type - Single or Future

Click the ellipsis

to choose S Single.

to choose S Single.

- Click Next Records.

- Complete the following fields:

- Line 120 - Date of check

- Line 140 - Amount of check

- Line 150 - Check number high

- Line 155 - Check number low

- Click OK.

- The Optional Records pane displays. The optional record item Stop Pay/Holds now has an asterisk next to it, indicating that one or more items have a stop payment action current.

- Click Yes.

- To create the stop payment record, click OK. The Stop Payment Request form prints.

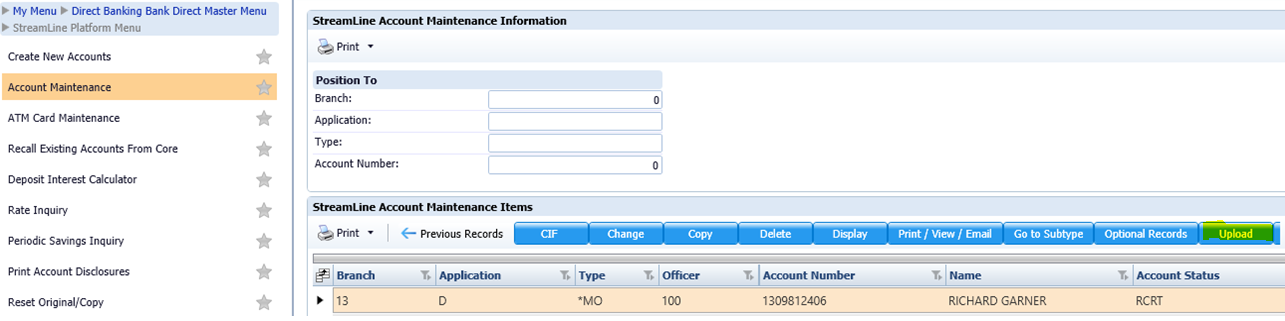

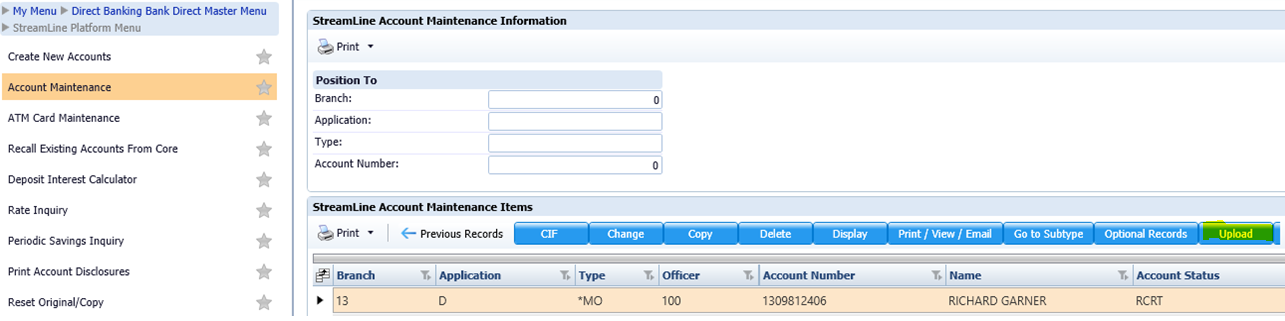

- Recall the account in account maintenance and upload the stop payment.

- Ensure the stop payment shows on the client’s account under Stops/Holds. Note: If the stop payment is not showing on the account, it did not upload.

- Complete the Stop Payment Request form. A new tab will display.

- If the stop payment form is not submitted using eSign, place with the daily work for imaging.

- Issue a money order as a replacement for the CCB issued check. See Issuing Money Orders.

- Prepare a debit memo using the account number the original was issued from. Complete the following information legibly on the debit memo:

- Date

- Original CCB issued official check number

- Client name

- Deposit account number from which the original lost, stolen, or destroyed check was issued

- Money order number issued as a replacement

- Issuing Office

- Associate 1st initial/last name and extension

- Account number the original item was issued from:

- Interest/Club Check - 100008211

- Expense Checks - 100007411

- Mortgage Servicing - 7375296601

- Residential Lending - 7370944601

- Loan Servicing Escrow - 7388541001

- Place the debit memo and the credit copy of the new money order in the teller work to run.

- Assess the stop payment fee to the client's account using fee code SP STOP PAYMENT FEE. See Assessing or Refunding Fees for procedures.